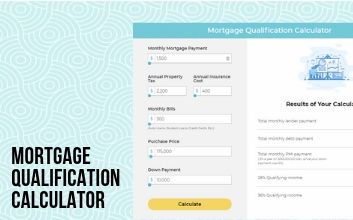

Vacation home mortgage qualification calculator

The tax savings from the loss helps pay for the vacation home. Low down payment mortgages are becoming more and more popular and by purchasing mortgage insurance lenders are comfortable with down payments as low as 3.

Vacation Home Mortgage Calculator Vacation Property Online

Tax laws are full of exceptions but the 14-day rulesometimes called the Masters exception because of its popularity in Georgia during the annual Masters golf tournamentis the most important for anyone considering renting out a vacation home.

. From pre-qualification to closing and every step in between we have a great library of resources to help your through the mortgage process. Department of Veterans Affairs VA Footnote 2 provide government insured or guaranteed mortgage programs with features such as low down payment options and flexible credit and income guidelines that may make it easier for first-time homebuyers to obtain home financing from lenders. Learn about the 14-day rule.

Home Equity Conversion Mortgage HECM This is a reverse mortgage program that assists 62-year-old seniors in converting their home equity into cash. So we created this First-Time Homebuyers Guide to help you prepare and guide you through the entire process from pre-qualification to closing - and beyond. Thats why lots of vacation homeowners hold down leisure use and spend lots of time maintaining the property.

We offer a range of mortgage options including fixed-rate 1 down Adjustable Rate Mortgage land and jumbo loans. In evaluating the adequacy of that system examiners review the relative importance of an individual control or lack thereof in the context of the entire system and whether the institution has other effective compensatory control procedures. Otherwise youre not seeing the complete picture.

Those with good credit. Mortgage insurance makes it possible for you to buy a home with less than a 20 down payment by protecting the lender against the additional risk associated with low down payment lending. Just make sure you use a mortgage calculator that considers the entire housing payment including taxes insurance HOA dues and so forth.

Leverage Your Home Equity Today. Also one of our Home Loan Experts would be happy to help if you give us a call at 800 785-4788. Based on your information the lender will give you a tentative assessment as to how much theyd be willing to lend you toward a home purchase.

HELOC Home Equity Loan Qualification. Mortgage rates valid as of 12 Sep 2022 0248 pm. The three primary things banks look at when assessing qualification for a home equity loan are.

HECM lets you tap your homes equity. The change is part of the company-wide mission of We are One Lennar A name change may not seem like a big dealafter all the opportunities products carefully selected team and high level of service remain the same. Conventional mortgage requirements allow you to finance a one- to four-unit home located in a regular subdivision condominium project co-op project or planned unit development PUD.

LTV definition and examples March 17 2022. As mentioned above banks typically allow a max LTV of 70 to 85. The FDIC views a sound vacation policy as one element of an institutions overall internal control system.

Our rate table lists the best current Redmond mortgage rates available from our lender network. The credit line option. Borrower must meet membership requirements to.

Fix-up days dont count as personal use. Whats in a name. Set your search criteria by entering your loan data and selecting the relevant products from the dropdown click search and well help you compare the market by showing you the most relevant offers for Redmond homeowners.

Buying your first home is a big deal. Since jumbo mortgages dont have the guarantees that come with conforming loans borrowers tend to be subject to greater scrutiny and may. Available equity in the home.

Mortgage pre-qualification is generally a quick simple process. Offer subject to termination at any time. Reverse Mortgage Line of Credit.

Also one of our Home Loan Experts would be happy to help if you give us a call at 800 785-4788. Under this rule you dont pay tax on income you earn from the short-term. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration. Find your dream home with SPIRE. Rates and terms are subject to qualification and may change at any time.

You can quickly tap into our robust knowledgebase learn about mortgage programs and best practices. Do bi-weekly mortgage programs pay your mortgage down faster. According to an article by AARP borrowers recognized this choice at about 66 of the time when obtaining a reverse mortgage as being the right choice for them.

A smoother more efficient home-buying experience. EEM is available as a home purchase tool and refinancing option. There is a lot more that goes into a mortgage than just the principal and interest and taxes and insurance can be quite costly depending on where you buy.

Up to 14 days or 10 the vacation home is considered a rental property and up to 25000 in losses might be deductible each year. You provide a mortgage lender personal financial information including your income debt and assets. The Federal Housing Administration FHA Footnote 1 and the US.

Borrowers can purchase a home used as a primary residence second home commonly called a vacation home or rental property. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. Todays Best Redmond Mortgage Rates.

Our rate table lists current home equity offers in your area which you can use to find a local lender or compare against other loan options. In 2021 the reverse mortgage line of credit continues to be the most popular option for homeowners when choosing how to access their funds. The goal is to lower your homes operating costs by improving its energy efficiency.

At Lennar Mortgage we have helped tens of thousands of first-time homebuyers just like you. People with an excellent credit score of above 760 will get the best rates. A jumbo loan or jumbo mortgage is a mortgage loan that exceeds the limits set by the Federal Housing Finance Agency FHFA.

It is exciting but can sometimes feel overwhelming. If you think youre ready to get started with your mortgage process check out Rocket Mortgage. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

As of December 5 Eagle Home Mortgage has a new nameLennar Mortgage. September 18 2018 Loan-to-value ratio for mortgage. Jumbo loans are called non-conforming loans because they dont conform to these limits.

Evolve S Vacation Rental Income Calculator Evolve Vacation Rental Rental Income Rental

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Free Financial Calculators For Excel

Vacation Rental Income Calculator Updated August 2022 Guest Hook

Va Loan Calculator

Seconds Home Mortgage Rates Are Going Up In 2022

Can I Afford A Second Home Calculator Vacation Property Online

Home Loan Calculators And Tools Hsh Com

How To Get A Mortgage For A Vacation Property Securing Financing For Secondary Properties

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Home Affordability Calculator Online Mortgage Calculator Ark Mortgage

How Much Vacation Home Can I Afford Vacation Property Online

The Mortgage Brothers Show Signature Home Loans Phoenix Az

Second Home Mortgage Calculator Vacation Property Online

Can I Afford A Vacation Home Calculator Vacation Property Online

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow